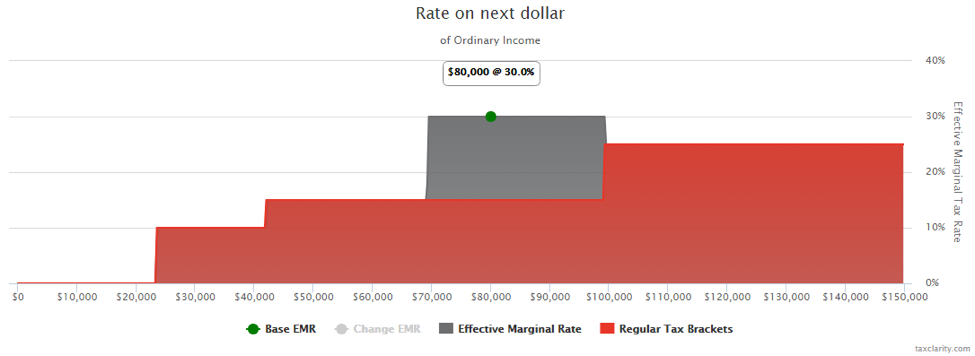

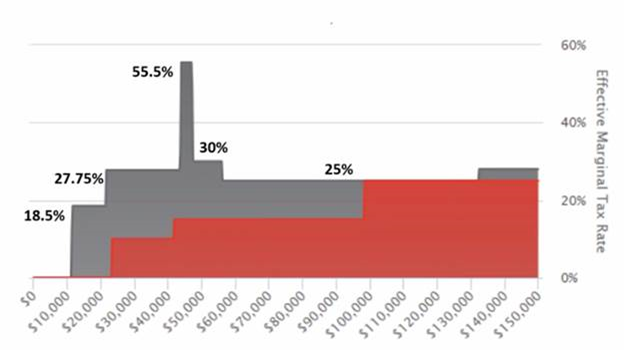

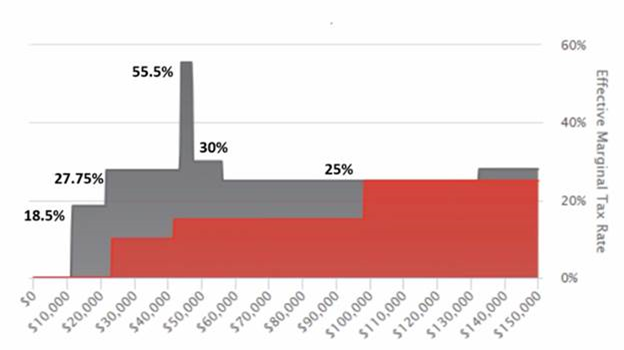

For many middle income people approaching retirement, a common question is whether to contribute to a traditional IRA or to a Roth IRA. Often, the rationale for contributing to the Roth or forgoing an IRA contribution altogether is that the client’s tax bracket in retirement is likely to be the same or potentially higher than it is now. Unfortunately, this shortcut often misses the point. When planning a retirement investment strategy, the client should be concerned less with the tax bracket and more with his effective marginal rate, or EMR. The EMR is the actual amount lost to taxes on each additional dollar of income, or conversely, it is the actual amount saved by making a contribution to the deductible IRA.

Read